Earnings growth rate formula

This constitutes a 30 rate of earnings growth. Divide the change in EPS by the initial EPS.

Peg Ratio Formula How To Calculate Price Earnings To Growth

For example you could accomplish this by comparing last years financial report to this years to look at how.

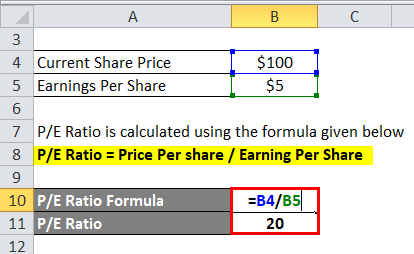

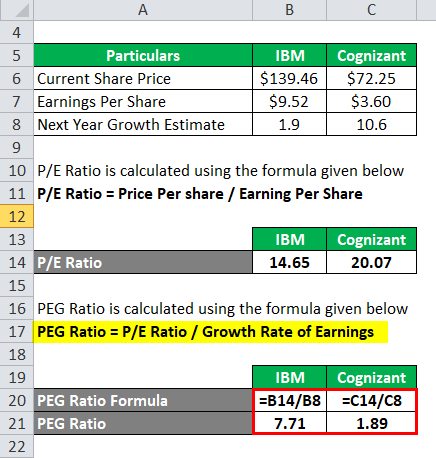

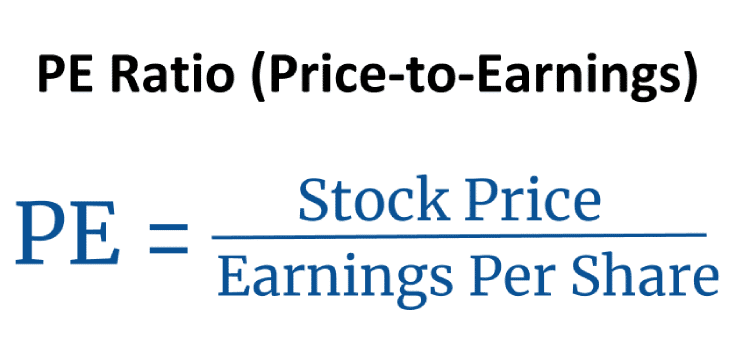

. We do this by dividing the latest earnings per share number. The basic PE formula takes the current stock price and EPS to find the current PE. The PEG ratio formula for a company is as.

Once you know how to calculate EPS for a company you can calculate the EPS growth rate. PriceEarnings-to-Growth PEG Ratio. The present value is given by.

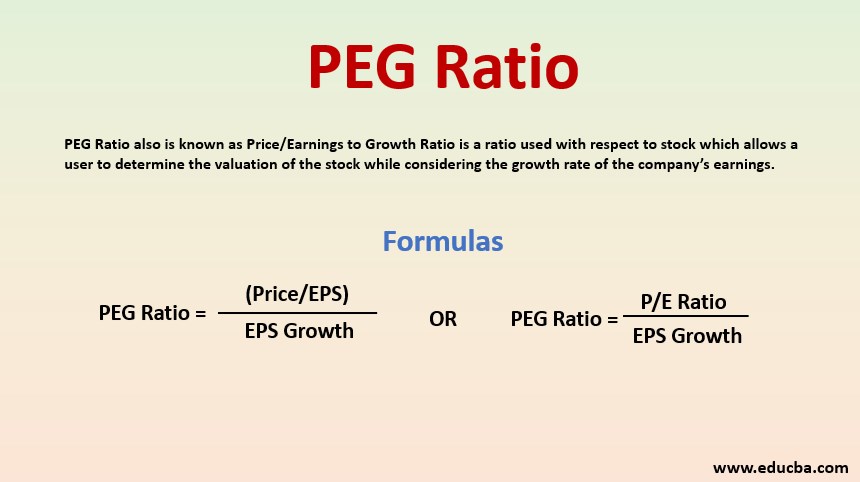

What is the PEG Ratio Formula. ROA Return on Assets Net Income Total Assets r Retention Rate Reinvested Earnings Net Income or 1 Dividend Payout Ratio How to Calculate Internal. Find Out How Edward Jones Can Assist in Reaching Your Goals.

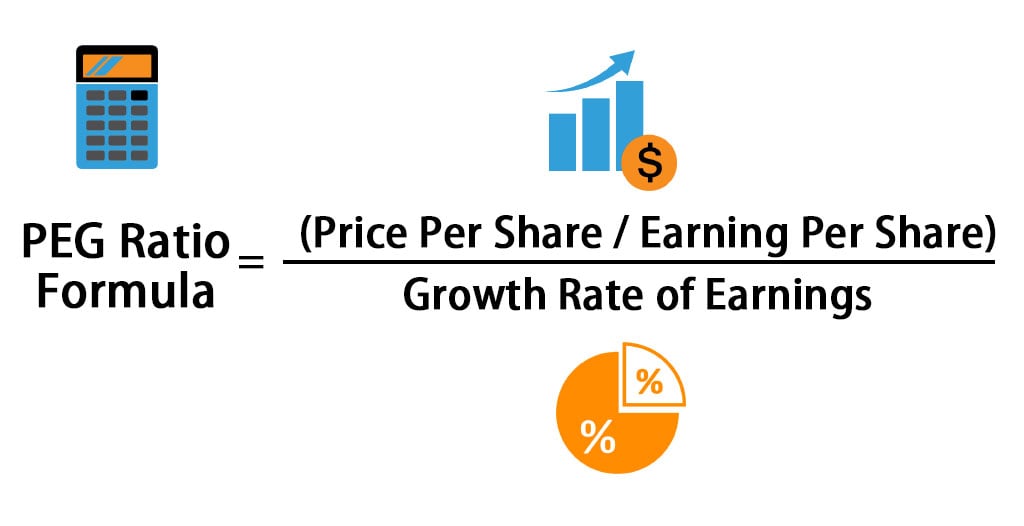

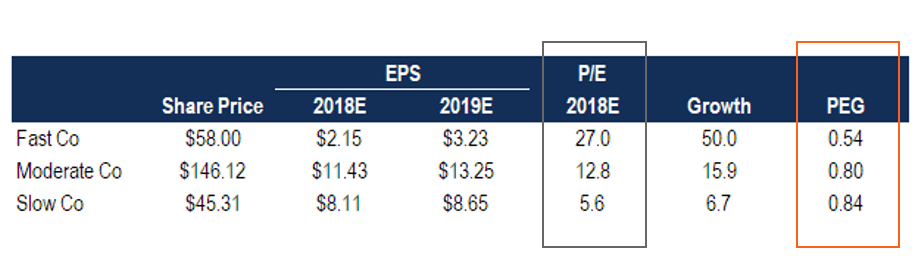

A PEG ratio is both grounded in objective information and is forward-looking a factor. On the Earnings growth ROIC x Reinvestment Rate formula General information If ROIC varies depending on the year and so does the reinvestment rate how can one calculate earnings. The PEG ratio priceearnings to growth ratio is a valuation metric for determining the relative trade-off between the price of a stock the earnings generated per share and the companys.

PE Ratio Formula Explanation. EPS Growth Formula EPS Growth EPS this year EPS last year 1 or When you need to calculate the compounded EPS growth rate of the company over a period of years. Ad Edward Jones Offers Financial Guidance Tailored to Your Goals.

Therefore the earnings development rate is one. A business reports 1 million of net income at the end of the year and then reports 13 million at the end of the following year. 00 100 500 divided by.

G Sustainable Growth Rate. Regarding instance the difference in this example is usually 100 000 and the original value can also be 100 000. The PEG formula consists of calculating the PE ratio and then dividing it by the long-term expected EPS growth rate for the next couple of years.

Priceearnings-to-growth Market price of stocks per shareEPS Earnings per share growth rate. P D i 1 1. Subtract the initial EPS from the final EPS.

EPS growth rate compares earnings per share over a period of time. To calculate Procter Gambles EPS growth rate over these nine years we must first calculate the growth multiple. Earnings growth rate is a key value that is needed when the Discounted cash flow model or the Gordons model is used for stock valuation.

EPS is found by taking. This can help adjust companies that have a high growth rate and a high price to earnings ratio.

Peg Ratio Formula How To Calculate Price Earnings To Growth

Peg Ratio Definition Equation Calculation

Price Earnings To Growth Peg Ratio Financial Edge

Peg Ratio Formula How To Calculate Price Earnings To Growth

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

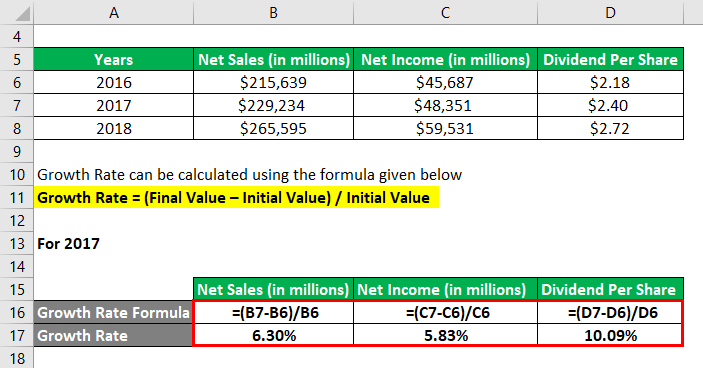

Growth Rate Formula Calculator Examples With Excel Template

Growth Rate Formula Calculator Examples With Excel Template

Earnings Per Share Eps Growth Calculator

Peg Ratio Price Earnings Growth Ratio What It Really Means

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template

Peg Ratio Example Explanation With Excel Template

Peg Ratio Vs Price To Earnings P E Ratio Youtube

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template

What Is Earnings Per Share Eps Eps Definition Calculation And Example

Sustainable Growth Rate Sgr Formula And Calculator Excel Template